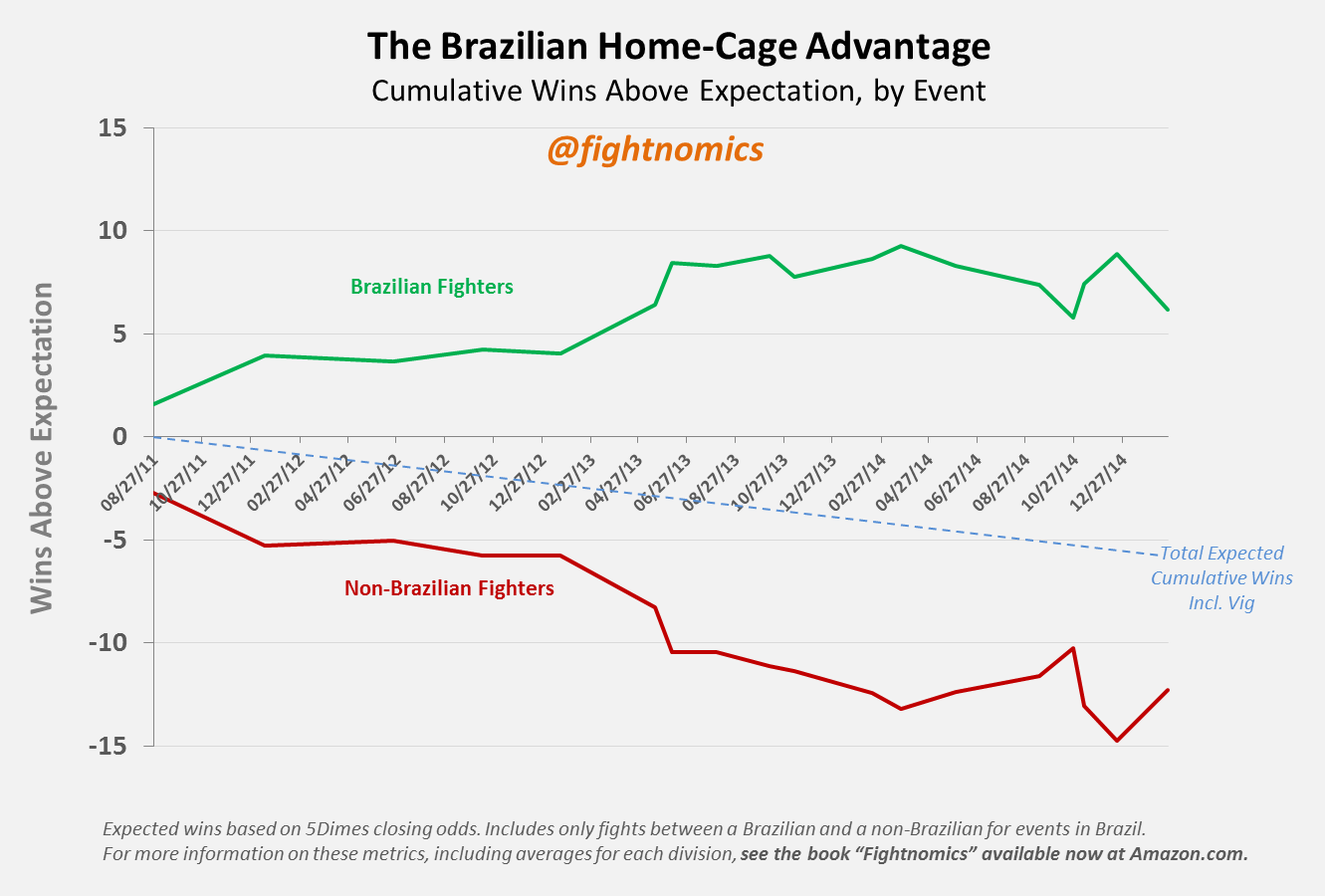

When the UFC returned to Brazil for Fight Night 61, it was the 19th card held there since the much celebrated “return” to Brazil in 2011. Early on, Brazilian fighters were on fire. In the first event, UFC 134, Brazilians facing foreign fighters went 7-1. In 2012 the UFC made three more trips to Brazil, with Home-Cage fighters going 14-5 at UFC 142, UFC 147, and UFC 153. The blossoming Brazilian MMA market was happier than ever before. But the high win rate for local fighters can be affected by a number of factors. Perhaps matchmakers were giving favorable pairings to local fighters to ensure a happy crowd. If true, this would be reflected in the betting odds, as the betting market is fairly adept at appraising matchups in the long run. Or maybe Brazilian fighters were truly getting a morale boost from the raucous crowds over their deer-in-headlights opponents, who had just been whispered the translation for “Uh, vai morrer!” Or maybe competing on foreign soil was simply more logistically difficult than American fighters were accustomed too, with diet and weight-cutting protocols so critical to modern MMA competition. The impressive win streak, whatever the reason, combined with often sweltering arena conditions, may have had American fighters dreading the phone calls from UFC matchmakers when it was time to book upcoming Brazilian cards. And according the betting odds anyway, the fighters who accepted an away-game billing in Brazil did indeed generally have the odds stacked against them. Brazilians fighters at UFC 134 averaged a -212 betting favorite by the market, yet they were still winning even more often than fans and bettors expected. In 2012 Brazilians weren’t as heavily favored, averaging just a -147 favorite, but they still maintained an edge over their expected win rate. Then in 2013, Home-Cage Brazilians got another bump, not just averaging -175 favorites, but still winning even more fights than expected. The hot streak of these first three years finally slowed down in 2014. The average Brazilian fighter with a Home-Cage advantage was just a -140 favorite, barely better than the pick ‘em -120 odds for all fighters, and weren’t outperforming the way they had in recent years. Their 39 wins tallied during 2014 were just more than the 37.9 wins expected by the implied odds. Matchmakers were setting more even matchups, and foreign fighters were performing closer to market expectations.

Wins above expectation is done from the point of view of betting odds, and there are several noteworthy points to consider. Overall, betting odds and the wisdom of crowds are fairly accurate in the long-run. But they also include the small margin built in for the profit of those who actually accept bets, the “vigorish.” The “vig” is the house margin that turns accepting bets into a profitable numbers game based on volume. So according the public odds, the long-run expected win rate for all fighters on average is actually slightly more than 50%. That means with enough fighters and fights, they’ll eventually fall short of the market implied win rate. Great for the house, not as much for anyone laying the small juice each time they play. In the context of the graph, Wins Above Expectation should be a losing proposition over the long run, a steadily declining line. That added burden to expectation makes the Brazilian streak of 2011-2014 even more impressive. Granted, the Home-Cage fighters were mostly favorites in Brazil, but they also won even more often than expected, while foreign fighters lost more often. However, that trend has been fading. Will 2015 show a bounce back towards renewed Brazilian intimidation or will a temporary competitive inefficiency be competed away? The recent Fight Night 61 event kicking off 2015’s UFC presence in Brazil could be the bellwether. That card, which saw a record night of upsets, also saw Brazilian fighters have a losing record, going 4-7 on the night. That was the most Home-Cage losses in any Brazilian event to date, and much less than the 6.7 expected wins according the market odds. But one event does not make a trend. Brazilians have still out-performed expectation over the long run to date, it just seems that they’ve plateaued recently. The normally cited explanations for the Home-Cage advantage could all be susceptible to a dropoff. American fighters have now been keeping up with the vig for almost a year, while the idea of a trip south has become far less intimidating. Fighters now all know what the fans are shouting at them, and perhaps even the logistics of an international fight week have improved. Habituation is the psychological effect of diminishing emotional response to repeated stimuli, meaning that, quite literally, fighters should be less and less intimidated by hostile environments the more they venture through them. The question of the Home-Cage advantage is greater and more nuanced than the results presented here. But at a high level, the recently fading trend makes sense and must have many North American fighters breathing a little easier when the matchmaker calls. After all, getting a free trip to Brazil isn’t a bad perk if you want to dovetail a vacation after a long fight camp.