The Strikeforce Effect: Part 2

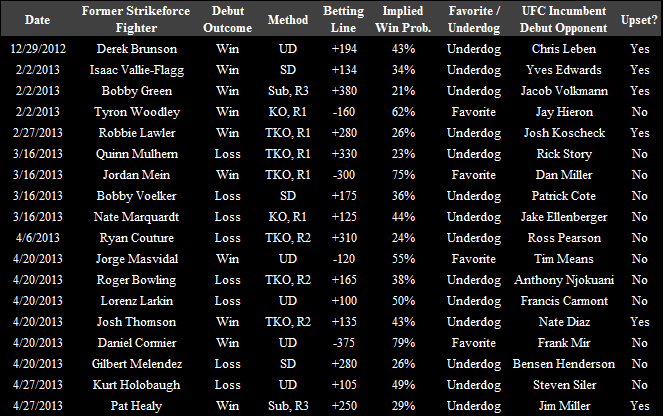

By Reed Kuhn @Fightnomics I previously introduced the idea that the betting public places high value on Octagon pedigree, and may be underestimating fighters crossing over from Strikeforce. If you haven’t read the full explanation of why this might be so, please do so here, and forgive the quick science lesson. The initial results supported the hypothesis that betting on Strikeforce fighters was presenting value. If anyone had simply bet equal amounts on every Strikeforce fighter making his UFC debut against an incumbent fighter since the December 2012 announcement of the end of Strikeforce, they would have returned a hefty 68% of profit in just over three months of events. Based on the dynamics of folding in fighters from a tombstoned promotion, essentially forcing them into the “major leagues,” it was expected that fans and the betting public might view them as tainted goods. And for good reason, too. The “Horn Effect” that causes us to be biased against individuals with a perceived negative contagion (e.g., coming from the “minor leagues” or second tier of competition in Strikeforce) should lead to deflated market prices set by the betting public. And when bias can be identified, it can be bet against profitably. Now in Part 2 of this experiment, we’ll take a look at the updated totals. Between the UFC on FOX 7 and UFC 159 events, there’s been an additional eight Strikeforce versus UFC incumbent matchups to analyze. The Updated Results to Date Since the Dec. 20th 2012 announcement of the end Strikeforce events, here’s how the crossover fighters have performed in their UFC debuts when facing incumbent UFC fighters.

By Reed Kuhn @Fightnomics I previously introduced the idea that the betting public places high value on Octagon pedigree, and may be underestimating fighters crossing over from Strikeforce. If you haven’t read the full explanation of why this might be so, please do so here, and forgive the quick science lesson. The initial results supported the hypothesis that betting on Strikeforce fighters was presenting value. If anyone had simply bet equal amounts on every Strikeforce fighter making his UFC debut against an incumbent fighter since the December 2012 announcement of the end of Strikeforce, they would have returned a hefty 68% of profit in just over three months of events. Based on the dynamics of folding in fighters from a tombstoned promotion, essentially forcing them into the “major leagues,” it was expected that fans and the betting public might view them as tainted goods. And for good reason, too. The “Horn Effect” that causes us to be biased against individuals with a perceived negative contagion (e.g., coming from the “minor leagues” or second tier of competition in Strikeforce) should lead to deflated market prices set by the betting public. And when bias can be identified, it can be bet against profitably. Now in Part 2 of this experiment, we’ll take a look at the updated totals. Between the UFC on FOX 7 and UFC 159 events, there’s been an additional eight Strikeforce versus UFC incumbent matchups to analyze. The Updated Results to Date Since the Dec. 20th 2012 announcement of the end Strikeforce events, here’s how the crossover fighters have performed in their UFC debuts when facing incumbent UFC fighters.

Source: All betting lines are quoted from Several Bookmakers.eu closing odds. Note: the announcement that the promotion was closing was made on Dec. 20th, 2012, but Strikeforce held their final event on January 12th, 2013. For the purposes of this analysis any Strikeforce fighter making a UFC debut after the date of announcement against a fighter with UFC experience was included. These are considered “forced crossovers,” as opposed to previously “cherry-picked” crossover talent. Strikeforce fighters making their debut against other Strikeforce fighters were not included. We’ll now revisit the total list of fights to date to examine the tally of expected versus actual wins. Total Fights:

- Crossover vs. Incumbent Record: 10-8

- Average Strikeforce Fighter Betting Line: +140

- Average Implied Win Rate: 42%

- Actual Win Rate: 56%

- Total Expected Wins: 7.5

- Total Actual Wins: 10

Favored Fighters:

- Favorite Record: 4-0

- Favorite Expected Wins: 2.7

- Favorite Actual Wins: 4

Underdog Fighters:

- Underdog Record: 6-8

- Underdog Expected Wins: 4.9

- Underdog Actual Wins: 6

When accounting for the betting line*, we see that most (14 of 18) of the Strikeforce fighters entered as underdogs, making their 10-8 far more impressive than the slight win/loss edge the record may indicate. Based on these implied market predictions, Strikeforce fighters should have only won 7.5 fights, but instead won 10. That’s why it’s important to factor in the context of expectations set by the market rather than just examine the record. The bottom line is that if you created a betting portfolio to simply put $100 on every Strikeforce fighter making his debut against a UFC incumbent, you would have turned a sizable profit during this period. Risking $1,800 would have given back $1,000 of that capital for the wins, plus another $1,578.83 in additional winnings for a total of $2,578.83. That’s a hefty return of 43% in just over three months. The dropping return rate compared to Part 1 of this analysis (which was formerly 68%), suggests the effect might be disappearing, or perhaps there’s some regression to the mean as the sample size grows. If we only considered the eight most recent fights (the Part 2 additions), our return rate actually drops to 12% on those bets alone. That’s much lower than our original return, but it’s still a positive return. Incidentally, a win for Gilbert Melendez in his close split decision fight with champion Benson Henderson would have boosted these results instantly back in line with the profit returns during Part 1 (back to 64% overall). That’s how close this portfolio was to truly studding out. But in MMA, anything can happen. As a +280 underdog Melendez certainly put in a valiant effort, but no one can argue with the end result in a fight that close. The results suggest that “we” collectively are still undervaluing these Strikeforce crossover fighters. They also suggest the effect may be diminishing. These calculations are based on the final odds at fight time, not the opening odds. So the market really is setting the price for these lines based on their betting actions. The Experiment Plays Out Here are the remaining Strikeforce fighters who will make their UFC debut against a UFC incumbent fighter. Again, Strikeforce fighters debuting against other Strikeforce fighters like Tim Kennedy vs. Roger Gracie at UFC 162 are not included. Nor are Strikeforce fighters who face a promotional newcomer from elsewhere. I’ve also excluded the debut of Trevor Smith because his opponent, Ed Herman, last fought in Strikeforce himself. Once a Strikeforce fighter has made their debut, they are no longer a crossover.

The rest of this Strikeforce experiment will finally play out over the summer as merger completes, and we’ll tally the final score for each side then. The bettors out there can put their money where their minds are by shorting the UFC incumbents if they believe the effect is real, or by ignoring the Strikeforce matchups if they believe the effect has since been absorbed by the market. Either way it’s been an interesting analysis of how psychological bias may be at work in hidden ways in professional sports, and the markets that attempt to evaluate them. Regardless of these betting lines, or the final matchup outcomes, it appears as though Strikeforce fighters have already earned some respect inside the Octagon, and the merger has been a success. The infusion of new talent has led to four different events being headlined by a debuting Strikeforce fighter (Rousey, Mousasi, Melendez and Rockhold), and many more that have highlighted new or recent Strikeforce crossovers in marquis fights. All in all, the Octagon is seeing more talent than ever before, and the fans will see the best fighters in the world compete in the same cage. The UFC has not forgotten an important rule of event promotion: never let your pipeline go dry. * End Note: Analysis of betting lines excluded the effect of the “vigorish” or “vig,” which reflects the bookmakers margin. If these were estimated and included in the implied win rates for each fight, the expected wins values would have been slightly lower, which would mean the bias effect is even larger than what I’ve shown here.